Three years after trumpeting ambitious plans to introduce the Himla sub-brand to Australian shores, Chery Australia has quietly shelved the project. Industry insiders familiar with the company’s operations revealed the Chinese automaker is instead throwing resources behind an accelerated development program for a larger plug-in hybrid vehicle designed explicitly to challenge BYD’s growing market share.

The dramatic shift caught many industry observers off guard. Chery’s local division had previously highlighted Himla as central to its Australian expansion strategy during numerous press events and dealer conferences held throughout late 2024.

Table of Contents

Behind Closed Doors: The Strategic Pivot

Whispers of the strategic reversal began circulating among dealer networks back in February. Several Melbourne-based dealerships had already begun preparations for Himla showroom installations before receiving word to halt these investments.

“We’d just signed off on the architectural plans when headquarters called everything off,” grumbled one Queensland dealer who requested anonymity due to ongoing relationships with Chery Australia. “First came the delays, then complete radio silence, and finally confirmation they’re killing Himla altogether for something else.”

The “something else” appears to be a dramatically different approach to capturing the Australian market share. Rather than establishing a separate identity through Himla, Chery has decided to leverage its established brand recognition while developing a direct competitor to BYD’s successful Tang PHEV SUV.

This abrupt change reportedly stems from disappointing focus group results. When shown concept designs and preliminary specifications for Himla vehicles, Australian consumers expressed confusion about the relationship between Himla and the parent company. Many questioned why they should trust an unknown brand rather than Chery’s increasingly recognized nameplate.

Also Read: 2025 Lexus LX 700h, Advanced Hybrid Tech in a Luxury SUV

The Reality of Australian Driving Needs

Beneath the corporate machinations lies a fundamental recognition of Australian driving patterns. Our vast distances and scattered charging infrastructure make pure electric vehicles impractical for many drivers outside major urban centers.

BYD recognized this reality early, focusing marketing efforts on their PHEVs’ ability to handle long-distance travel while offering zero-emission commuting. The strategy resonated particularly well with families requiring versatile transportation without range anxiety.

Chery’s market research revealed similar patterns. Internal documents leaked to industry publications suggest the company’s surveys found 78% of potential Australian buyers ranked “total driving range” as their top concern when considering electrified vehicles. This far outpaced other considerations like performance or technology features.

“Australians aren’t afraid of new technology, but they’re bloody practical about their needs,” noted veteran automotive journalist Richard Hartley. “A PHEV that can handle the school run on electricity but still manage a trip to Grandma’s six hours away makes sense in our market.”

Technical Ambitions Beyond BYD

While Chery remains tight-lipped about specifics, technical documents shared with potential supplier partners reveal ambitious performance targets for their upcoming PHEV:

| Feature | Chery’s Target | Current BYD Tang | Typical Segment Average |

|---|---|---|---|

| Electric Range | 85-90 km | 80 km | 60-65 km |

| System Power | 390+ kW | 363 kW | 320-340 kW |

| Towing Capacity | 2,350 kg | 2,000 kg | 1,750-1,950 kg |

| 0-100 km/h | 4.9 seconds | 5.2 seconds | 5.8-6.2 seconds |

| Fast Charging | 20-80% in 28 min | 20-80% in 35 min | 20-80% in 38-45 min |

| Warranty | 7-year/unlimited km | 6-year/150,000 km | 5-year/100,000 km |

These figures, if achieved in production form, would position Chery’s offering ahead of BYD across virtually every meaningful metric. Particularly noteworthy is the emphasis on extended electric range, addressing a key consideration for Australian buyers hesitant about embracing electrification.

“They’re clearly shooting for class leadership rather than mere competitiveness,” observed Melbourne-based automotive engineer Sarah Tennant. “The question isn’t whether these specs look good on paper—it’s whether they can deliver them at a price point that makes sense for their target market.”

Manufacturing Realities and Challenges

Pivoting from the Himla program hasn’t been without significant challenges. Production lines previously configured for the scrapped models required extensive retooling, causing ripple effects throughout Chery’s global manufacturing network.

Workers at Chery’s Wuhu plant report round-the-clock shifts as the company rushes to prepare for production. Components originally destined for Himla vehicles are being evaluated for compatibility with the new PHEV architecture, with usable parts repurposed to minimize waste and control costs.

Supply chain bottlenecks remain a potential stumbling block. Battery cell procurement in particular has proven challenging, with key suppliers already committed to fulfilling contracts with established manufacturers. Chery has reportedly offered premium pricing to secure necessary production capacity.

“The entire industry faces the same battery supply constraints,” explained procurement analyst Michael Chen. “Chery’s advantage lies in their willingness to accept slimmer margins initially to secure market position—something their corporate structure allows more readily than publicly-traded rivals.”

Aggressive Pricing Strategy

During private dealer briefings held last month, Chery executives outlined pricing targets that raised eyebrows throughout the room. The proposed structure represents a bold attempt to undercut BYD’s Australian pricing:

| Trim Level | Target Chery PHEV Price | Comparable BYD Model | Current BYD Price |

|---|---|---|---|

| Entry | $41,990 drive-away | Tang Standard Range | $48,800 plus on-roads |

| Mid-spec | $48,990 drive-away | Tang Extended Range | $54,990 plus on-roads |

| Flagship | $57,990 drive-away | Tang Ultimate | $67,800 plus on-roads |

Such aggressive pricing would position Chery’s offerings significantly below BYD’s established models while promising superior specifications. The strategy reflects Chery’s willingness to sacrifice short-term profitability for market share—a common approach among Chinese manufacturers seeking international expansion.

“These aren’t sustainable margins long-term,” admitted one Chery representative speaking unofficially after the dealer presentation. “We’re viewing initial pricing as a marketing investment rather than a profit center. Once we’ve established market presence, more balanced pricing structures will follow.”

Dealer Network Expansion Plans

Concurrent with product development, Chery continues aggressively expanding its Australian dealer footprint. Current plans call for 48 dealership locations operational by year-end—a substantial increase from today’s network of 29 outlets.

The expansion focuses particularly on regional areas where BYD’s presence remains limited. Recent property acquisitions in Ballarat, Bendigo, Bunbury and Rockhampton suggest Chery is targeting mid-sized population centers underserved by existing EV infrastructure.

Dealer training programs now emphasize PHEV technology education rather than the previously planned Himla brand introduction. Updated sales materials focus heavily on explaining plug-in hybrid advantages in consumer-friendly language, addressing research showing widespread confusion about different electrification approaches.

“Most Aussies still struggle with basic hybrid terminology,” noted Chery’s dealer training coordinator during a recent instructional seminar. “Our job isn’t just selling cars—it’s educating customers about technology that genuinely suits their lifestyle better than they might realize.”

Marketing Shift: From Brand Building to Direct Competition

With Himla plans abandoned, Chery’s marketing department faces the challenge of rapidly pivoting messaging. Draft advertising materials previously focused on establishing Himla as a premium alternative have been scrapped in favor of campaigns emphasizing Chery’s established global presence and technological capabilities.

Television commercial storyboards recently shared with marketing partners show a dramatic shift in approach. Rather than abstract brand-building exercises, new concepts feature direct real-world comparisons between Chery’s upcoming PHEV and “leading competitor models”—thinly veiled references to BYD’s offerings.

Social media strategy documents reveal plans for targeted campaigns highlighting specific Chery advantages, particularly regarding battery management technology and warranty coverage. This represents a significantly more confrontational approach than previously planned under the Himla strategy.

“The gloves are coming off,” remarked digital marketing consultant Jessica Williams, who previously worked with several automotive brands. “Chery clearly sees no benefit in polite market entry when direct confrontation offers faster market penetration.”

Customer Perception Challenges

Despite aggressive expansion plans, Chery faces significant perception hurdles among Australian buyers. Recent market research indicates only 37% of potential car shoppers could correctly identify Chery as a Chinese manufacturer, with many confusing it with Japanese or Korean brands.

This brand ambiguity presents both challenges and opportunities. While Chery lacks the established reputation of longtime market participants, it also escapes some negative perceptions occasionally associated with Chinese manufacturing.

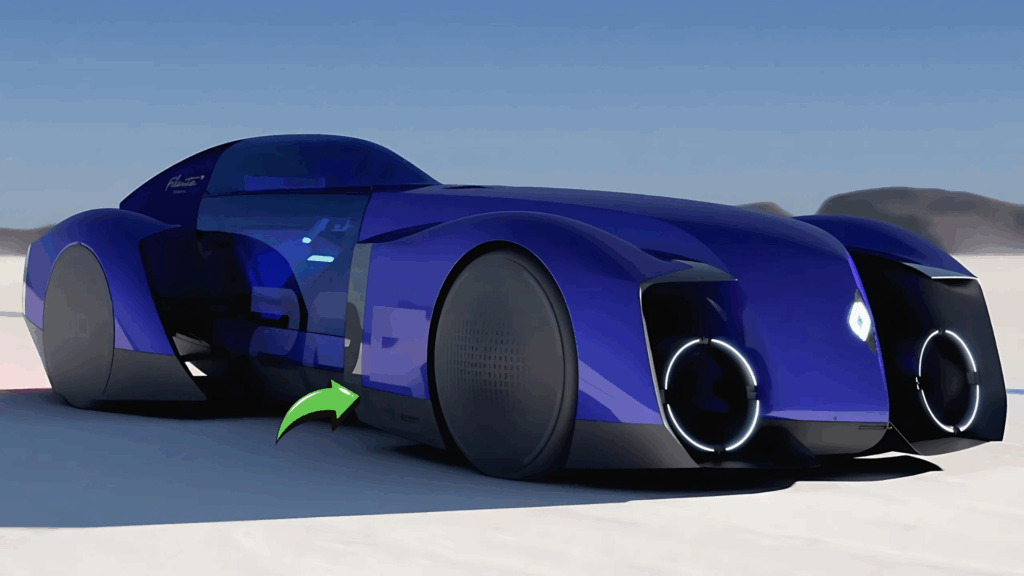

Focus group participants shown concept images of the upcoming PHEV (without brand identification) rated design and apparent quality highly. When subsequently informed the vehicle was a Chery product, opinion softening was minimal compared to reactions to other Chinese brands—suggesting the company has already made significant inroads in perception management.

“Younger buyers particularly show remarkable openness to Chery products,” noted consumer behavior researcher Emma Davidson. “Our data suggests buyers under 40 evaluate these vehicles primarily on feature content and value proposition rather than country of origin.”

Infrastructure and Regulatory Considerations

Chery’s PHEV strategy aligns neatly with Australia’s patchy charging infrastructure. By offering substantial electric range for daily commuting while maintaining petrol backup for longer journeys, these vehicles sidestep concerns about charging network limitations.

The company has nevertheless, begun exploring infrastructure partnerships. Discussions with several charging network operators suggest Chery may offer subsidized home charger installations for PHEV buyers, potentially including reduced rates at public charging stations through partnership arrangements.

From a regulatory standpoint, PHEVs occupy a beneficial middle ground. They qualify for various incentive programs targeting lower-emission vehicles while avoiding potential future restrictions on pure internal combustion engine vehicles already being discussed in some jurisdictions.

“Chery’s betting on PHEVs as the sweet spot for Australian conditions over the next decade,” suggested transport policy analyst James Robertson. “Pure EVs will eventually dominate, but our infrastructure reality means that transition will happen more gradually than in more densely populated markets.”

Long-term Strategic Implications

Chery’s dramatic strategy shift carries broader implications for Australia’s automotive landscape. Rather than creating artificial brand separation through sub-brands like Himla, Chinese manufacturers increasingly appear willing to leverage their established corporate identities while competing directly on technical merit and value proposition.

This approach signals growing confidence in product quality and diminishing concern about potential negative perceptions of Chinese-branded vehicles. The willingness to directly challenge established competitors like BYD demonstrates remarkable market maturity from companies that entered international markets relatively recently.

“We’re witnessing the normalization of Chinese automotive brands in the Australian consciousness,” observed industry consultant Lisa Chen. “The hesitancy to prominently display Chinese origins is fading as these companies deliver genuinely competitive products rather than mere budget alternatives.”

For Australian consumers, this competitive dynamic promises continued downward pressure on vehicle pricing across segments. As Chery and BYD battle for market share, established Japanese and Korean manufacturers face increasing pressure to match value propositions or risk erosion of their traditional market positions.

Frequently Asked Questions

When will Chery’s new PHEV arrive in Australia?

First deliveries are expected in late September 2025, with full model range availability by November.

Will the new model qualify for government incentives?

Yes, current regulations indicate these vehicles will qualify for existing PHEV rebates in all Australian states and territories.

How does the warranty compare to other brands?

Chery plans to offer a 7-year/unlimited kilometer warranty, exceeding most competitors in the segment.

Are trade-in incentives available for existing Chery owners?

Yes, loyalty bonuses between $2,000 $ 3,500 will be offered to current owners upgrading to the new models.